This blog follows on from last week's blog on the most innovative countries for robotics. That blog analysed data from our Ideas Catalog to see which countries had the most tech companies per head of population. Switzerland came out top. This blog will look into some possible reasons for this.

But first, in carrying out this study I came across some interesting research from the World Intellectual Property Organization [Source]. In 2015 they also looked at the most innovative countries but from a completely different perspective. They analysed seven core elements including institutions, human capital and research, infrastructure, market and business sophistication, knowledge and technology tools, and creative outputs. Interestingly, Switzerland came top in their list as well! And there is plenty of commonality at the top.

Based on the World Intellectual Property Organization's results, Credit Suisse attributes Switzerland’s title of ‘Most Innovative Country’ to two factors: foreign investment and world-renowned institutions; three quarters of funding for research and development comes from foreign investors and the Swiss Federal Institute of Technology Zurich (ETHZ) and EPFL in Lausanne are in the top 20 universities worldwide. The universities apply for approximately 200 patents every year.

This ties in very well with our own research that conclude there are two key drivers to innovation: access to top Universities and provision of funding from all sources.

Universities as a driver for innovation

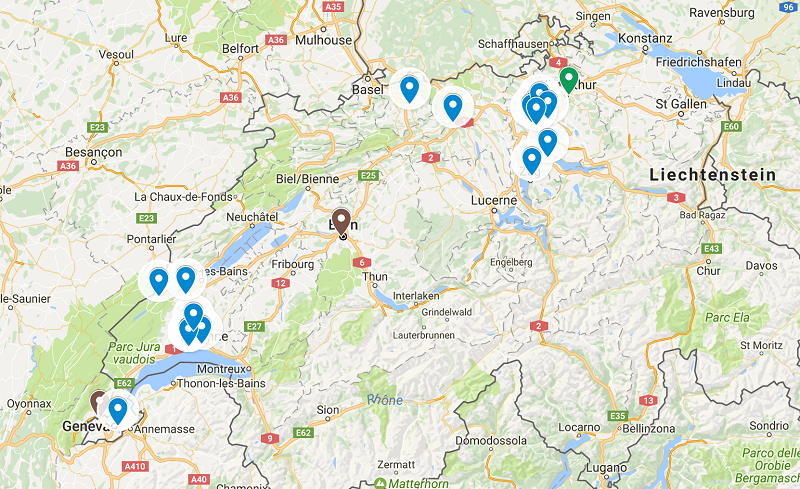

First, looking at Universities, you can see a clear clustering of vendors around the top Universities in the world. Both ETH and EPFL are based In Zurich and these two of the best Universities in the world for robotics. The map below shows the clustering of vendors, shown in blue, around the Universities, shown in green.

In the US, Boston is home to MIT and Harvard and the area surrounding is home to the most concentrated technology vendors in the world.

Similar effects are seen in Pittsburgh (CMU), Detroit (University of Michigan), Philadelphia (University of Pennsylvania) and San Diego (University of California). All these Universities are carrying out top class research in robotics and related technologies and so seem to be a catalyst for creating new technology.

Provision of funding as a driver for innovation

In order for someone to start a new company they need customers to sell to. Without any customers they have no reason to exist. Someone needs to spend money in order for another to receive an income. In other words:

Spending = Income

Spending can come from three sources: private spending, government spending and foreign spending. Credit Suisse considered that foreign investment (so called FDI - Foreign Direct Investment) was the main reason for innovation success but our study suggests that is too narrow a definition. All spending streams will contribute to innovation including private and government spending. As an example, look at the cluster of vendors in San Francisco and Los Angeles. Yes, there are some top tech Universities in those cities (Stanford and the University of California for instance), but it is the prevalence of private funding in those areas that are the bigger drivers.

Government spending can be seen to create clusters of tech vendors around National Laboratories and Government Institutions such as in New Mexico (LANL and Sandia) and Washington DC/Baltimore. However, the impact of government spending is seen more through its spread across the country where many firms rely on government contracts for their income.

There is some clustering around three major conurbations; Manchester, Bristol and Southampton that all have top quality Universities and are vibrant centres for commerce.

Why growth is necessary to provide funding

Having said that funding, from the private sector, government or FDI is a necessity, this can only happen when there is GDP growth. Without growth, the economy stagnates and firms compete for market share. New vendors have to displace existing vendors. New vendors also need customers and with low or no growth, customers are reluctant to spend. And as stated earlier in this blog; spending = income. If fewer people spend then fewer people can derive an income and they themselves spend less resulting in a ruinous cycle of less and less spending. So, if the private sector are hesitant to invest (because potential customers have less to spend) and FDI is reduced for the same reason, there is only one funding source remaining - government spending. I can thoroughly recommend this blog by Bill Mitchell that explains this further. It covers all things to do with macroeconomics.

Conclusion

Our analysis complements other analysis that suggests that both top quality universities and access/provision of funding are necessary drivers for innovation. It is not about growing skills, increased training or anything to do with the supply side that is currently fashionable (except for the provision of a learning capability provided by Universities). It is about creating a demand. Having customers generates innovation and this generates jobs that provide people an income with which they can spend. That is a virtuous cycle. Governments play a key role in supporting universities and providing funding to firms (not just grants and contracts but in growing the economy so that there are more customers). In the absence or reduction of private and foreign investment, governments will need to increase their contribution. After all spending = income. We believe it will result in a virtuous cycle of growth, innovation and good jobs.